Welcome to a glimpse into the future of insurance payments! In our exploration of the evolving landscape, we’ll journey from traditional methods to the digital era, where convenience and security reign supreme. One noteworthy player in this transformation is “Foremost Insurance Online Pay,” a platform reshaping how policyholders manage their payments. Join us as we delve into its benefits and step-by-step guide. Additionally, we’ll unveil the platform’s commitment to security and privacy, anticipating future trends like mobile payment integration and enhanced accessibility. Embrace the future of insurance payments with us!

The Evolution of Insurance Payments

As technology continues to advance, the insurance industry has also embraced digital transformation, including the way insurance payments are made. Let’s take a closer look at the evolution of insurance payment methods, from traditional to online payments.

Traditional Insurance Payment Methods

Traditionally, insurance payments were made through conventional methods such as cash, checks, or money orders. Customers would physically visit their insurance provider’s office or send payments through mail. While these methods were widely used in the past, they had limitations in terms of convenience and speed. Customers had to allocate time to visit the office or wait for the mail to deliver their payment, which could be time-consuming and sometimes prone to delays.

The Rise of Online Payments

With the advent of the internet and the increasing popularity of online transactions, insurance payment methods have significantly evolved. Online payments have revolutionized the insurance industry, providing customers with a quicker, more convenient, and secure way to make their insurance payments.

Through online payment systems, customers can now make their insurance payments from the comfort of their own homes or on the go. This digital shift has eliminated the need for physical visits or reliance on postal services, making the payment process more efficient and accessible.

Online payments also offer additional benefits such as real-time payment confirmation, electronic receipts, and the ability to schedule recurring payments. This level of convenience and automation allows customers to better manage their insurance payments and stay on top of their financial obligations.

One example of an online payment platform is Foremost Insurance Online Pay, which provides policyholders with a seamless and secure way to make their insurance payments. By leveraging digital technology, Foremost Insurance Online Pay streamlines the payment process, offering a range of benefits to policyholders.

Understanding the evolution of insurance payments sets the stage for exploring the specific features and advantages of Foremost Insurance Online Pay. Let’s dive deeper into this online payment solution and discover how it can enhance your insurance payment experience.

Introducing Foremost Insurance Online Pay

In today’s digital age, the convenience of online payments has revolutionized various industries, including insurance. Foremost Insurance Online Pay is a secure and user-friendly platform that allows policyholders to make their insurance payments online, providing a hassle-free experience.

What is Foremost Insurance Online Pay?

Foremost Insurance Online Pay is an online payment service offered by Foremost Insurance. It enables policyholders to conveniently pay their insurance premiums through a secure online platform. With Foremost Insurance Online Pay, policyholders can easily manage their payments from the comfort of their own homes, at any time that suits them.

Benefits of Using Foremost Insurance Online Pay

Using Foremost Insurance Online Pay offers several advantages for policyholders:

- Convenience: With Foremost Insurance Online Pay, policyholders can say goodbye to writing and mailing checks or visiting physical payment centers. They can make payments quickly and effortlessly from their computer or mobile device, saving valuable time and effort.

- Flexibility: Foremost Insurance Online Pay allows policyholders to choose from various payment options, including credit cards, debit cards, or electronic fund transfers. This flexibility allows policyholders to select the payment method that works best for them.

- Real-time Access: By using Foremost Insurance Online Pay, policyholders have access to real-time information about their payments. They can view their payment history, check the status of their payments, and receive immediate confirmation once a payment is processed.

- Security: Foremost Insurance places a high priority on the security of its online payment platform. They employ advanced encryption technologies to protect sensitive payment information, ensuring that policyholders’ data remains secure.

- Saves Paper and Resources: By opting for Foremost Insurance Online Pay, policyholders contribute to environmental sustainability by reducing the need for paper checks and physical mail. This not only saves resources but also helps reduce the carbon footprint.

By introducing Foremost Insurance Online Pay, Foremost Insurance aims to provide policyholders with a convenient and secure way to manage their insurance payments. The platform offers numerous benefits, including flexibility, real-time access to payment information, and enhanced security measures. To learn more about making payments through Foremost Insurance Online Pay, visit their official website at foremost insurance payment.

How Foremost Insurance Online Pay Works

Foremost Insurance Online Pay provides a convenient and secure way to make insurance payments from the comfort of your home or on the go. Understanding how this online payment system works is essential for a seamless and hassle-free experience.

Step-by-Step Guide to Making Payments

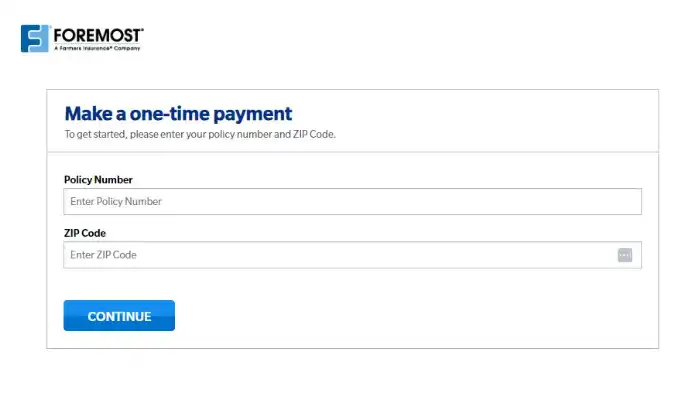

Making payments through Foremost Insurance Online Pay is a straightforward process. Follow these steps to complete your payment:

- Visit the Foremost Insurance Online Pay Website: Go to the official Foremost Insurance Online Pay website to access the payment portal. You can find the link to the website here.

- Log In or Create an Account: If you are a returning user, log in using your existing credentials. For new users, create an account by providing the necessary information, such as your policy details and contact information.

- Enter Payment Details: Once you are logged in, enter the required payment details, including the amount you wish to pay and the payment method you prefer.

- Select Payment Method: Foremost Insurance Online Pay supports various payment methods, ensuring flexibility and convenience. Choose from the available options, such as credit card, debit card, or electronic funds transfer (EFT).

- Review and Submit: Double-check the payment details to ensure accuracy. Take a moment to review the payment amount, due date, and any applicable fees. Once you are satisfied, submit your payment.

- Confirmation and Receipt: After submitting your payment, you will receive a confirmation message indicating that your payment has been successfully processed. You may also receive an electronic receipt for your records.

Supported Payment Methods

Foremost Insurance Online Pay offers a range of payment methods to accommodate different preferences. Here are the supported payment methods:

| Payment Method | Description |

|---|---|

| Credit Card | Make payments using major credit cards, such as Visa, Mastercard, or American Express. |

| Debit Card | Utilize your debit card to conveniently settle your insurance payments. |

| Electronic Funds Transfer (EFT) | Link your bank account to initiate electronic transfers for seamless payments. |

By providing multiple payment options, Foremost Insurance Online Pay ensures that you can choose the method that best suits your needs and preferences.

In addition to the step-by-step guide and supported payment methods, it’s important to note that Foremost Insurance Online Pay prioritizes the security and privacy of your information.

To learn more about Foremost Insurance Online Pay and its features, please visit the official website here.

Security and Privacy

When it comes to making insurance payments online, security and privacy are paramount concerns. Foremost Insurance Online Pay prioritizes the safety of your information and has implemented robust measures to ensure the protection of your data.

Ensuring the Safety of Your Information

Foremost Insurance Online Pay employs industry-standard security protocols to safeguard your personal and financial information. When you make a payment through the platform, your data is encrypted using SSL (Secure Socket Layer) technology. This encryption ensures that your information is transmitted securely and cannot be intercepted by unauthorized individuals.

To further enhance security, Foremost Insurance Online Pay has implemented multiple layers of authentication. This helps to prevent unauthorized access to your account and ensures that only authorized individuals are able to make payments on your behalf.

Privacy Measures in Place

Foremost Insurance Online Pay is committed to maintaining the privacy of your personal information. The platform adheres to strict privacy policies to protect your data from unauthorized use or disclosure. Your information is collected and stored in accordance with applicable laws and regulations.

Foremost Insurance Online Pay does not sell or share your personal information with third parties for marketing purposes. Your data is only used for the purpose of processing your insurance payments and providing you with the necessary services.

To learn more about making payments through Foremost Insurance Online Pay, refer to our article on foremost insurance payment.

By prioritizing security and privacy, Foremost Insurance Online Pay ensures that your information remains safe and confidential throughout the payment process. You can have peace of mind knowing that your sensitive data is protected and that your privacy is respected.

Future Trends in Insurance Payments

As the insurance industry continues to evolve, so do the methods and technologies used for insurance payments. In this section, we will explore two future trends that are shaping the landscape of insurance payments: mobile payment integration and enhanced convenience and accessibility.

Mobile Payment Integration

With the increasing prevalence of smartphones and mobile devices, mobile payment integration is becoming a significant trend in the insurance industry. Insurance companies are recognizing the importance of providing customers with the flexibility to make payments directly from their mobile devices. This trend allows policyholders to conveniently manage their insurance payments on the go.

Mobile payment integration offers several benefits, including ease of use and accessibility. Policyholders can make payments anytime, anywhere, without the need for a computer or visiting a physical payment location. This convenience makes it easier for individuals to stay on top of their insurance payments, reducing the risk of missed or late payments.

Additionally, mobile payment integration often incorporates secure payment technologies, such as tokenization and encryption, to safeguard sensitive financial information. This provides peace of mind to policyholders, knowing that their payment details are protected.

Enhanced Convenience and Accessibility

In addition to mobile payment integration, the future of insurance payments is focused on enhancing convenience and accessibility for policyholders. Insurance companies are actively exploring ways to streamline the payment process and make it as user-friendly as possible.

This includes implementing features such as personalized payment portals and online accounts, where policyholders can easily view and manage their payment information. By providing a centralized platform, insurance companies aim to simplify the payment experience and reduce the time and effort required for policyholders to make payments.

Furthermore, insurance companies are investing in user-friendly interfaces and intuitive payment systems. The goal is to make the payment process seamless and straightforward, even for individuals who are not tech-savvy. By prioritizing user experience, insurance companies are striving to ensure that policyholders can easily navigate the payment process and complete transactions without frustration.

By embracing mobile payment integration and focusing on enhanced convenience and accessibility, the insurance industry is adapting to the changing needs and preferences of policyholders. These future trends aim to make insurance payments more efficient, secure, and user-friendly. As technology continues to advance, we can expect further innovations in insurance payment methods, ultimately providing policyholders with a more seamless and convenient payment experience.