When it comes to dealing with insurance claims, writing an effective insurance claim letter is crucial. A well-crafted claim letter serves as an official document that communicates your request for compensation or coverage to the insurance company. In this section, we will explore the importance of insurance claim letters and the key elements that make them effective.

Importance of Insurance Claim Letters

Insurance claim letters play a vital role in the claims process. They provide a written record of your claim, ensuring that all parties involved have a clear understanding of the incident and the compensation you are seeking. Here are some reasons why insurance claim letters are important:

- Formal Request: A claim letter is a formal way to request compensation or coverage for a loss, damage, or injury covered by your insurance policy. It helps establish your intent to make a claim and initiates the claims process.

- Documentation: A claim letter serves as a documented record of the incident, providing important details such as the date, time, and nature of the incident. It also serves as evidence of your efforts to report the claim in a timely manner.

- Clarity and Organization: Writing a claim letter allows you to clearly articulate the details of the incident, including the cause of the loss or damage, the parties involved, and the amount you are claiming. This helps avoid any miscommunication or misunderstanding with the insurance company.

- Legal Protection: A well-written claim letter can help protect your legal rights. It ensures that you provide all the necessary information required for a fair assessment of your claim and establishes a clear timeline of events.

Key Elements of an Effective Insurance Claim Letter

To increase the chances of a successful claim, an effective insurance claim letter should include the following key elements:

- Clear and Concise Introduction: Start your letter with a clear and concise introduction that states your intent to make a claim and provides essential details such as your policy number, the date and time of the incident, and a brief overview of the situation.

- Detailed Description of the Incident: Provide a detailed account of the incident, including the cause, location, and any relevant circumstances. Be specific and include any supporting documentation, such as photos or witness statements, to strengthen your claim. For more information on gathering supporting evidence, refer to our article on how to find my homeowners insurance policy.

- Supporting Documentation and Evidence: Include any relevant documents that support your claim, such as police reports, medical records, repair estimates, or receipts for damaged items. Organize these documents in a clear and logical manner to facilitate the claims process.

By understanding the importance of insurance claim letters and incorporating these key elements, you can effectively communicate your claim to the insurance company. Remember to use professional and polite language throughout the letter and provide accurate and relevant details to support your claim.

Getting Started

Before writing an insurance claim letter, it is essential to gather all the necessary information to strengthen your case and ensure a smooth claims process. Additionally, it is crucial to follow the guidelines provided by your insurance company to maximize the chances of a successful claim.

Gather All Necessary Information

To effectively communicate your claim to the insurance company, you need to gather the following information:

- Policy details: Have your insurance policy number readily available. This information is typically found on your insurance card or policy documents.

- Date and time of the incident: Provide the exact date and time when the incident occurred. This helps the insurance company assess the timeline of events.

- Description of the incident: Provide a clear and detailed account of what happened. Include relevant details such as the location, circumstances leading to the incident, and any other pertinent information.

- Witness statements: If there were any witnesses to the incident, try to obtain their statements or contact information. Witness statements can provide additional evidence to support your claim.

- Photos and videos: Take pictures or videos of the damaged property or any other evidence related to your claim. Visual documentation can help strengthen your case.

- Police reports or incident reports: If applicable, include copies of police reports or incident reports related to the incident. These documents provide an official record of the incident.

- Medical records: If your claim involves injuries, include relevant medical records, such as doctor’s notes, test results, and medical bills. These records provide evidence of the extent of your injuries and the associated costs.

Follow the Insurance Company’s Guidelines

Each insurance company may have specific guidelines and procedures for filing a claim. It is crucial to familiarize yourself with these guidelines and follow them diligently. This ensures that your claim is processed efficiently and reduces the chances of any unnecessary delays or complications.

Refer to your insurance policy documents or contact your insurance agent to obtain the specific guidelines for filing a claim. These guidelines may include instructions on the preferred method of claim submission, specific forms to complete, and any additional documentation required.

By gathering all necessary information and following your insurance company’s guidelines, you can lay a solid foundation for your insurance claim letter. This preparation increases the likelihood of a successful claim and a smoother claims process overall.

Structuring Your Insurance Claim Letter

When writing an insurance claim letter, a clear and organized structure can greatly enhance its effectiveness. This section outlines the key components to include in your letter: a clear and concise introduction, a detailed description of the incident, and supporting documentation and evidence.

Clear and Concise Introduction

Begin your insurance claim letter with a clear and concise introduction. State your purpose for writing the letter and provide essential details, such as your policy number and the date of the incident. It is important to address the letter to the appropriate department or individual within the insurance company.

Example:

Dear [Insurance Company Name],

I am writing this letter to file a claim regarding [incident description] that occurred on [date]. My policy number is [policy number]. I am seeking compensation for the damages incurred as a result of this incident.

Detailed Description of the Incident

In the body of your insurance claim letter, provide a detailed description of the incident. Clearly and objectively explain what happened, including relevant dates, times, and locations. Use factual language and avoid exaggerations or emotional language.

Include specific details about the damages or losses sustained. If applicable, describe any injuries sustained and medical treatments received. It is important to provide a comprehensive and accurate account to support your claim.

Example:

On [date], at approximately [time], [describe the incident in detail]. As a result, I experienced damages to [describe the damages], including [specific items or areas affected]. I have attached photographs of the damages for your reference. Additionally, I incurred medical expenses for [specific treatments or consultations] as a result of injuries sustained during the incident.

Supporting Documentation and Evidence

To strengthen your insurance claim, include supporting documentation and evidence. This may include photographs of the damages, medical bills, repair estimates, police reports, or any other relevant documents. Ensure that all documentation is clear and legible.

Refer to the attachments in your letter and provide a brief description of each document. This helps the insurance company easily identify and review the supporting evidence.

Example:

Please find attached the following documents for your review and consideration:

- Photographs of the damages sustained (Attachment A)

- Medical bills and invoices for treatments received (Attachment B)

- Repair estimates from certified professionals (Attachment C)

- Police report filed on [date] (Attachment D)

These documents provide detailed evidence of the damages and expenses incurred as a direct result of the incident.

By structuring your insurance claim letter in a clear and organized manner, you can effectively communicate your claim to the insurance company. Remember to use professional and polite language throughout the letter. Providing a detailed description of the incident and including supporting documentation will help support the validity of your claim.

Writing Tips for Your Claim Letter

When writing an insurance claim letter, it’s important to craft a clear and compelling document that effectively communicates your case to the insurance company. Here are some essential writing tips to help you create an impactful claim letter.

Use Professional and Polite Language

Maintaining a professional and polite tone throughout your claim letter is crucial. Remember, you are addressing a representative of the insurance company who will be assessing your claim. Use courteous language and avoid using any offensive or confrontational remarks. A respectful tone will help to establish a positive and cooperative relationship with the insurance company.

Provide Relevant Details and Facts

To make your claim letter effective, provide all the relevant details and facts related to the incident. Clearly state the date, time, and location of the incident, as well as a detailed description of what occurred. Include any relevant information such as witness statements, police reports, or medical documentation to support your claim. Providing accurate and comprehensive information will strengthen your case and make it easier for the insurance company to assess your claim.

Be Specific and Accurate

When describing the incident, be specific and accurate in your account. Use precise language to convey the details of what happened, including any damages or injuries sustained. Avoid vague or general statements that may cause confusion or ambiguity. Being specific and accurate will help the insurance company understand the extent of your claim and make a fair assessment.

In addition to these writing tips, it’s important to familiarize yourself with the specific requirements and guidelines set forth by your insurance company. By following their guidelines and providing all the necessary information, you can increase the chances of a successful claim. Remember, if your claim is denied or delayed, there are steps you can take to appeal the decision. Check out our article on how to appeal a denied claim for more information.

By utilizing professional language, providing relevant details and facts, and being specific and accurate in your claim letter, you can effectively communicate your case to the insurance company and increase the likelihood of a successful outcome.

Submitting Your Claim Letter

Once you have written your insurance claim letter, it’s time to submit it to the insurance company. This section will guide you through the preferred methods of submission and the importance of follow-up and documentation.

Preferred Methods of Submission

Insurance companies usually provide multiple methods for submitting claim letters. The most common methods include:

- Online Portal: Many insurance companies have online portals where you can submit your claim letter electronically. These portals provide a convenient and secure way to upload your documents and track the progress of your claim. It is important to ensure that you follow the specific instructions provided by your insurance company regarding file formats, size limits, and any additional documentation required.

- Email: Some insurance companies allow claim letters to be submitted via email. When sending your claim letter via email, make sure to attach all relevant documents in a format specified by the insurance company. It is advisable to include a clear and concise subject line that indicates the purpose of the email, such as “Insurance Claim Letter – [Your Name]”.

- Postal Mail: Traditional mail is another option for submitting your claim letter. Prepare a printed copy of your claim letter and all supporting documentation. Place them in an envelope and send it to the address provided by the insurance company. It is recommended to use certified mail or a similar service that provides proof of delivery. This way, you can track the delivery status and have evidence of submission.

When choosing the method of submission, consider the urgency of your claim and the preferences of your insurance company. It is always a good idea to retain copies of all documents submitted for your own records.

Follow-Up and Documentation

After submitting your claim letter, it is essential to follow up with the insurance company to ensure that your claim is being processed. Keep a record of all communication, including dates, times, and the names of any representatives you speak with.

If you submitted your claim electronically through an online portal or email, you may receive automated acknowledgments or reference numbers. Make note of these details for future reference.

For claims submitted via postal mail, it is advisable to allow sufficient time for the letter to reach the insurance company. Once the expected delivery time has passed, you can contact the insurance company to confirm receipt of your claim letter.

Throughout the claims process, be proactive in gathering any additional documentation or information requested by the insurance company. This may include medical records, repair estimates, or any other evidence related to your claim. Promptly provide these documents to avoid delays in the assessment of your claim.

By maintaining thorough documentation and following up with the insurance company, you can stay informed about the progress of your claim. If you have any concerns or questions during the process, don’t hesitate to reach out to the insurance company for clarification or assistance.

Remember, the submission of your claim letter is just the first step. Stay organized, be responsive, and maintain open lines of communication to increase the likelihood of a successful claim resolution.

Dealing with Claim Denials or Delays

Sometimes, insurance claims may be denied or delayed for various reasons. It can be frustrating, but it’s important to understand the reasons behind these outcomes and the steps you can take to appeal a denied claim.

Reasons for Denial or Delay

There are several reasons why an insurance claim may be denied or delayed. Some common reasons include:

- Lack of coverage: The incident or damage may not be covered under your insurance policy. It’s crucial to carefully review your policy to understand the specific coverage details.

- Insufficient documentation: If the documentation or evidence provided is incomplete, unclear, or does not support the claim, the insurance company may deny or delay the claim until additional information is provided.

- Policy exclusions: Certain policy exclusions may prevent coverage for specific situations or events. It’s important to be aware of these exclusions when filing a claim.

- Failure to meet policy requirements: Insurance policies often have specific requirements that must be met in order to make a claim. Failure to meet these requirements may result in claim denial or delay.

- Discrepancies or inaccuracies: Inconsistencies or inaccuracies in the information provided can raise red flags for the insurance company, leading to further investigations or claim denials.

It’s essential to carefully review the denial or delay letter provided by the insurance company. The letter should outline the specific reasons for the decision, allowing you to address any issues and take appropriate action.

Steps to Appeal a Denied Claim

If your insurance claim is denied, it doesn’t necessarily mean the end of the road. You have the right to appeal the decision. Here are some steps you can take to appeal a denied claim:

- Review the denial letter: Carefully read the denial letter to understand the reasons for the denial. Take note of any documentation or information that may be missing or incorrect.

- Contact your insurance company: Reach out to your insurance company’s claims department to discuss the denial. Ask for clarification on the reasons behind the decision and inquire about the appeals process.

- Gather additional evidence: If there are any missing documents or evidence that could support your claim, gather them promptly. This may include photographs, repair estimates, medical records, or any other relevant information.

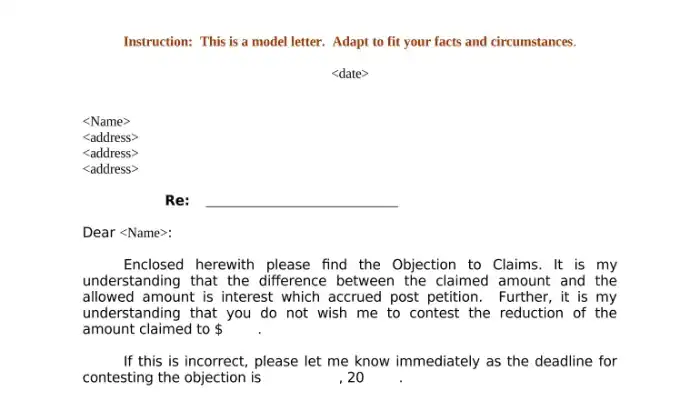

- Prepare an appeal letter: Write a clear and concise appeal letter addressing the reasons for the denial. Include any additional evidence or information that supports your claim. Be sure to use professional and polite language throughout the letter.

- Submit the appeal letter: Send the appeal letter to your insurance company via certified mail or email, ensuring that you have proof of submission. Follow any specific instructions provided by the insurance company for the appeals process.

- Follow up and document: Keep records of all communication with the insurance company regarding your appeal. Follow up regularly to check on the status of your appeal and provide any additional information requested.

Remember, the appeals process may take time, so it’s important to be patient and persistent. If you need assistance with the appeal process, consider consulting with an attorney or seeking guidance from a consumer protection agency.

Dealing with claim denials or delays can be challenging, but understanding the reasons behind these outcomes and taking proactive steps to appeal can increase your chances of a successful resolution.