Foremost Insurance is a well-known insurance provider that offers a range of insurance coverage options to meet the needs of its customers. Whether it’s home insurance, auto insurance, or other specialized policies, Foremost Insurance strives to provide reliable coverage and peace of mind. One important aspect of Foremost Insurance is the Foremost Insurance Card. In this blog post, we are going to discuss about Foremost Insurance Card, its purpose, information included on this card, and how to obtain & use the Foremost Insurance Card.

Introduction to Foremost Insurance

Foremost Insurance is a reputable insurance company that has been operating for many years. They are known for their expertise in providing coverage for various types of properties, including homes, mobile homes, and recreational vehicles. Foremost Insurance aims to protect their customers’ valuable assets by offering comprehensive insurance policies tailored to their specific needs.

Foremost Insurance understands that accidents and unexpected events can occur, leading to financial burdens. With their range of insurance options, they aim to alleviate these concerns by providing coverage that extends beyond basic homeowner or auto insurance policies.

Importance of the Foremost Insurance Card

The Foremost Insurance Card plays a crucial role in ensuring that policyholders have easy access to important information about their insurance coverage. The card serves as proof of insurance and includes key details that may be required in various situations, such as accidents, claims, or interactions with authorities.

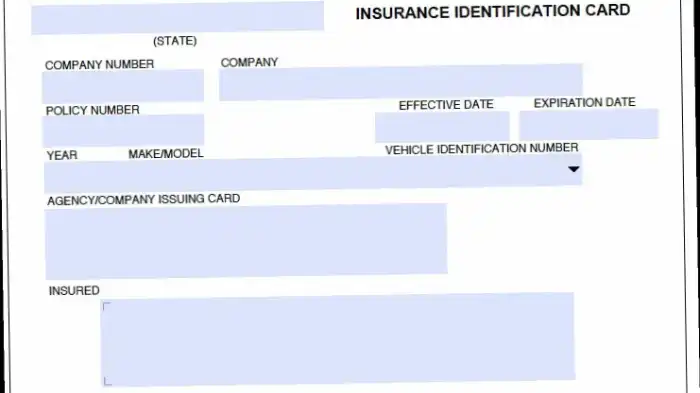

The Foremost Insurance Card provides essential information, including:

- Policyholder’s name

- Policy number

- Effective dates of coverage

- Vehicle or property covered

- Contact information for Foremost Insurance

Having the Foremost Insurance Card readily available is important as it allows policyholders to quickly provide proof of insurance when necessary. Whether it’s during a traffic stop, an accident, or when interacting with other parties involved in a claim, having the card on hand helps facilitate a smooth process.

Additionally, the Foremost Insurance Card serves as a reminder for policyholders to review their coverage periodically and ensure that it aligns with their current needs. It’s important to keep the card in a safe place and carry it with you whenever you’re operating a vehicle or need to provide proof of insurance.

Understanding Foremost Insurance and the importance of the Foremost Insurance Card is essential for policyholders. By familiarizing themselves with the coverage and information provided on the card, individuals can confidently navigate situations where proof of insurance is required.

What is the Foremost Insurance Card?

The Foremost Insurance Card is a vital document that policyholders receive after obtaining insurance from Foremost Insurance. This card serves as proof of insurance coverage and contains important information that may be required in various situations.

Purpose and Function of the Insurance Card

The purpose of the Foremost Insurance Card is to provide tangible proof of insurance coverage. It serves as evidence that you have an active insurance policy with Foremost Insurance and helps establish your financial responsibility in case of an accident or incident. The card typically includes your policy number, the effective dates of coverage, and the name of the insured.

The insurance card also plays a crucial role when interacting with authorities, such as law enforcement officers or government agencies. It is often required during traffic stops, vehicle inspections, or when registering a vehicle. In these situations, presenting a valid insurance card demonstrates compliance with the laws and regulations governing insurance coverage.

Key Information Included on the Card

The Foremost Insurance Card contains essential information that allows others to verify your insurance coverage. Some of the key details typically included on the card are:

- Policyholder Information: The primary policyholder’s name is listed on the card. This is the person who holds the insurance policy with Foremost Insurance.

- Policy Number: The insurance card displays a unique policy number that identifies your specific insurance coverage. This number is used to reference your policy when communicating with Foremost Insurance.

- Effective Dates: The card indicates the period during which your insurance policy is active. It shows the start and end dates of your coverage, ensuring that you are aware of the timeframe for which your policy is in effect.

- Insurance Company Information: The insurance card includes the name and contact information of Foremost Insurance, allowing others to verify the legitimacy of your coverage.

- Vehicle Information (if applicable): If your insurance policy covers a vehicle, the insurance card may also include details such as the make, model, and vehicle identification number (VIN) of the insured vehicle.

It’s essential to keep your Foremost Insurance Card readily accessible, as you may need to present it when requested by authorities or when verifying your insurance coverage. If you have any questions about your insurance card or need to request a replacement, reach out to Foremost Insurance directly.

Obtaining Your Foremost Insurance Card

When you have a Foremost insurance policy, it’s important to have your insurance card readily available. The insurance card serves as proof of insurance coverage and contains important information about your policy. Here’s how you can obtain your Foremost insurance card and the options available to you.

How to Obtain the Card

Once you have purchased a Foremost insurance policy, you will typically receive your insurance card from your insurance provider. The card is usually mailed to you along with your policy documents. It’s important to keep the insurance card in a safe place, such as your wallet or glove compartment, so that you can easily access it when needed.

If you haven’t received your insurance card or have misplaced it, you can contact your insurance provider directly to request a replacement. They will be able to assist you in obtaining a new card and can provide you with any additional information you may need. Remember to have your policy details and identification information readily available when contacting your insurance provider.

Digital and Physical Card Options

Foremost insurance offers both digital and physical insurance card options to provide convenience and flexibility to policyholders.

Digital Insurance Card: Many insurance providers now offer digital insurance cards that can be accessed through a mobile app or online account. Digital insurance cards are a convenient option as they can be easily stored on your smartphone or other electronic devices. They can be presented as proof of insurance coverage when needed, such as during a traffic stop or when filing a claim.

Physical Insurance Card: If you prefer a physical copy of your insurance card, you can request one from your insurance provider. They will typically mail you a physical card that you can carry with you. It’s important to note that physical insurance cards can easily get lost or damaged, so it’s a good idea to make a copy or take a photo of your card as a backup.

Whether you choose a digital or physical insurance card, make sure to keep it up to date. If any changes are made to your policy, such as updates to your coverage or personal information, contact your insurance provider to obtain an updated card.

By obtaining your Foremost insurance card and keeping it easily accessible, you can ensure that you have the necessary proof of insurance coverage whenever it’s required. Whether you choose a digital or physical option, having your insurance card on hand provides peace of mind and ensures that you can quickly verify your coverage details when needed.

Using Your Foremost Insurance Card

Once you have obtained your Foremost Insurance card, it is important to understand how to effectively use it when needed. The card serves as proof of your insurance coverage and provides essential information about your policy. In this section, we will discuss how to present the card when needed and how to verify your coverage and policy details.

Presenting the Card When Needed

When you find yourself in a situation where you need to provide proof of insurance coverage, such as during a traffic stop or when filing a claim, it is essential to have your Foremost Insurance card readily available. Here are some key points to keep in mind when presenting your card:

- Keep it accessible: Store your Foremost Insurance card in a safe and easily accessible location, such as your wallet or glove compartment. This way, you can quickly retrieve it when needed.

- Provide a legible copy: Ensure that the card you present is clear and legible. If you are using a digital copy, make sure it is readily viewable on your electronic device. This will help expedite the process and prevent any delays in verifying your coverage.

- Follow the officer’s instructions: If you are presenting your card during a traffic stop, follow the instructions of the law enforcement officer. They may ask you to hand over the physical card or display the digital copy on your device. Cooperate and provide the requested information promptly.

Verifying Coverage and Policy Details

Apart from serving as proof of insurance, your Foremost Insurance card also contains important details about your coverage. It is essential to verify these details to ensure that you have the necessary protection. Here are the key pieces of information typically included on the card:

- Policyholder Information: The card will display your name as the policyholder. Confirm that the information is accurate and matches your identification.

- Policy Number: The card will include your unique policy number. This number is essential when communicating with your insurance provider or when filing a claim. Make sure to keep it secure and readily accessible.

- Effective Dates: The card will indicate the start and end dates of your policy’s coverage period. Familiarize yourself with these dates to ensure that your coverage is active when needed.

- Contact Information: The card will provide contact details for Foremost Insurance, such as phone numbers or website information. In case of any questions or emergencies, refer to this information to reach out to your insurance provider.

Remember, while your Foremost Insurance card is an important document, it does not contain all the policy details. For a comprehensive understanding of your coverage, refer to your policy documentation or contact Foremost Insurance directly.

Understanding how to present your Foremost Insurance card when needed and verifying your coverage and policy details will help ensure a smooth process when dealing with insurance-related situations. Always keep your card accessible and up-to-date to avoid any complications.

Frequently Asked Questions

Here are some frequently asked questions about the Foremost Insurance Card:

What should I do if I lose my Foremost Insurance Card?

Losing your Foremost Insurance Card can be a hassle, but there are steps you can take to address the situation. If you misplace your card, it’s important to contact your insurance provider as soon as possible. They will assist you in obtaining a replacement card. Be prepared to provide them with the necessary information to verify your identity and policy details. Remember, it’s crucial to keep your insurance card in a safe place to avoid any inconvenience in the future.

Can I use a digital copy of the card?

Yes, many insurance providers now offer the option to use a digital copy of your insurance card. This digital version can be stored on your smartphone or other electronic devices for easy access when needed. However, it’s important to check with your insurance provider to ensure that digital copies are accepted. Some states or situations may require a physical card, so it’s always a good idea to keep a physical backup of your insurance card as well.

How often should I update my Foremost Insurance Card?

It’s important to update your Foremost Insurance Card whenever there are changes to your policy or personal information. This includes updating your card if you change vehicles, add or remove drivers, or make modifications to your coverage. By keeping your insurance card up to date, you ensure that the information presented is accurate and reflects your current coverage. If you have any doubts or questions about updating your card, reach out to your insurance provider for guidance.

The Foremost Insurance Card serves as an essential document that provides important information about your insurance coverage. Understanding how to handle situations such as losing your card, the use of digital copies, and the importance of keeping your card updated will help you navigate the insurance process with confidence.