Navigating through the complexities of insurance can be overwhelming, but understanding your foremost insurance declaration page is a crucial step towards informed decision-making. Often referred to as a policy summary, this document holds the key to unlocking the specifics of your coverage.

In this blog, we’ll break down the essential components of the Foremost insurance declaration page, helping you decipher policy information, coverage details, and the financial aspects of premiums and deductibles. Whether you’re a seasoned policyholder or a newcomer to insurance, gaining clarity on your declaration page empowers you to make confident choices for your protection.

What is a Foremost Insurance Declaration Page?

A Foremost insurance declaration page, also known as a policy summary, is a document issued by the Foremost insurance company that provides a concise overview of your Foremost insurance policy. It contains key information about your coverage, such as the types of coverage you have, the coverage limits, and the policy exclusions. The declaration page serves as a reference point for understanding the specifics of your insurance policy.

Why is the Declaration Page Important?

The declaration page holds significant importance for both policyholders and insurance companies. Here’s why:

- Policyholder Understanding: The declaration page helps policyholders understand the details of their insurance coverage, including the types of coverage they have, the coverage limits, and any exclusions. This knowledge allows policyholders to make informed decisions regarding their insurance needs and ensures they have the necessary coverage to protect their assets.

- Proof of Insurance: The declaration page serves as proof of insurance, providing evidence that you have an active policy with the insurance company. This document is often required when purchasing a new vehicle, renting a property, or obtaining a loan.

- Quick Reference: In the event of a claim or any changes to your policy, the declaration page serves as a quick reference for your coverage details. It provides a summary of your policy, making it easier to communicate with your insurance company or agent, and ensuring you have the necessary information readily available.

- Policyholder Verification: The declaration page allows policyholders to verify that the information provided by the insurance company is accurate. It includes details such as the policy number, effective dates, and the named insured, which can be cross-referenced with other policy-related documents to ensure accuracy.

By thoroughly reviewing your insurance declaration page, you can gain a clear understanding of your coverage, including the different types of coverage, coverage limits, and any exclusions that may apply. If you have any questions or need to make changes to your policy, it’s important to reach out to your insurance agent or company for clarification.

Key Components of the Foremost Insurance Declaration Page

Understanding the key components of your Foremost insurance declaration page is essential for comprehending the details of your insurance policy. The declaration page provides a summary of your policy and contains important information related to your coverage. Let’s explore the three main components of the declaration page: policy information, coverage details, and premiums and deductibles.

Policy Information

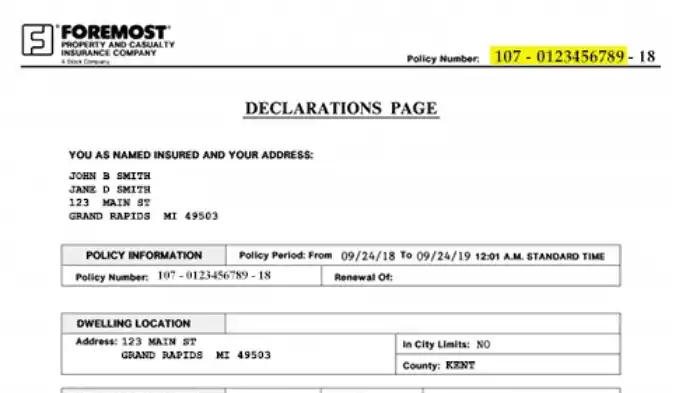

The policy information section of the Foremost insurance declaration page includes vital details about your insurance policy. It typically consists of the following elements:

- Policy Number: This unique identifier helps to distinguish your policy from others. It is important to reference the policy number when communicating with your insurance company or agent.

- Effective Dates: The effective dates specify the period during which your policy is in force. It is crucial to be aware of these dates to ensure continuous coverage.

- Named Insured: The named insured refers to the person or entity who is covered under the insurance policy. It is essential to verify that the named insured accurately represents the individuals or entities that should be covered.

To better understand the policy information section, you can refer to our article on foremost insurance policy information.

Coverage Details

The coverage details section outlines the specific aspects of your insurance coverage. It includes information about the types of coverage provided, coverage limits, and policy exclusions. Understanding these details is crucial for knowing what is covered and what may not be covered by your policy.

- Types of Coverage: This portion of the declaration page lists the different types of coverage included in your policy. Common types of coverage may include liability coverage, property coverage, medical payments coverage, and more.

- Coverage Limits: Coverage limits indicate the maximum amount that your insurance company will pay for a covered loss. It is important to review these limits to ensure they align with your needs and expectations.

- Policy Exclusions: Policy exclusions specify what is not covered by your insurance policy. It is essential to be aware of these exclusions to avoid any surprises when filing a claim.

For further information on coverage details, you can visit our article on foremost insurance coverage details.

Premiums and Deductibles

The premiums and deductibles section provides information about the financial aspects of your insurance policy. It includes details about the premium amount, deductible amount, and payment schedule.

- Premium Amount: The premium amount is the cost you pay for your insurance coverage. It may be paid annually, semi-annually, quarterly, or monthly, depending on your payment schedule.

- Deductible Amount: The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Higher deductibles often result in lower premiums, while lower deductibles typically lead to higher premiums.

- Payment Schedule: The payment schedule indicates the frequency at which you are required to make premium payments. It is important to adhere to the payment schedule to maintain continuous coverage.

To learn more about premiums and deductibles, you can refer to our article on foremost insurance premiums and deductibles.

By understanding the policy information, coverage details, and premiums and deductibles outlined in your insurance declaration page, you can make informed decisions about your coverage, review your policy regularly, and ensure that your insurance meets your specific needs.

Deciphering the Foremost Insurance Policy Information

When you receive your Foremost insurance declaration page, it’s essential to understand the policy information section, as it provides crucial details about your insurance coverage. Here are the key components within the Foremost Insurance policy information section:

Policy Number

The policy number is a unique identifier assigned to your insurance policy. It helps the insurance company track and locate your specific policy among their records. When communicating with your insurance provider, referring to your policy number ensures accurate and efficient assistance.

Effective Dates

The effective dates on the declaration page specify the period during which your insurance policy is valid. It indicates the start and end dates of your coverage. It’s important to review these dates to ensure that your policy is active and provides the protection you need. If the dates don’t align with your expectations, contact your insurance agent immediately.

Named Insured

The named insured refers to the individual or entity that holds the insurance policy. This could be an individual, a family, a business, or any other entity that has purchased the insurance coverage. It’s crucial to ensure that the named insured information is accurate and up to date on the declaration page. If any changes are necessary, contact your insurance agent to make the appropriate updates.

Understanding the policy information section of your insurance declaration page is fundamental to knowing the specifics of your coverage. By familiarizing yourself with the policy number, effective dates, and named insured details, you can ensure that the information accurately reflects your insurance policy. If you have any questions or need to make changes to your policy, don’t hesitate to reach out to your insurance agent for assistance.

Digging into Coverage Details

When reviewing your insurance declaration page, it’s essential to understand the coverage details provided. This section will delve into the types of coverage, coverage limits, and policy exclusions outlined on the declaration page.

Types of Coverage

The declaration page will specify the different types of coverage included in your insurance policy. Common types of coverage may include:

- Property Coverage: This type of coverage protects your property, such as your home or belongings, against covered perils like fire or theft.

- Liability Coverage: Liability coverage provides financial protection in the event that you’re found responsible for causing bodily injury or property damage to others.

- Medical Payments Coverage: Medical payments coverage helps cover medical expenses for individuals injured on your property, regardless of fault.

- Additional Living Expenses Coverage: If your home becomes temporarily uninhabitable due to a covered loss, additional living expenses coverage can help pay for temporary housing and other related costs.

It’s important to carefully review the types of coverage listed on your declaration page to ensure they align with your insurance needs.

Coverage Limits

Coverage limits refer to the maximum amount your insurance policy will pay for a covered loss. The declaration page will outline the specific coverage limits for each type of coverage included in your policy. For instance, property coverage limits may vary for your dwelling, personal property, or other structures on your property.

Understanding your coverage limits is crucial to ensure you have adequate protection. If your coverage limits are too low, you may be responsible for covering additional expenses out of pocket. On the other hand, excessively high coverage limits may result in unnecessary premium costs.

Policy Exclusions

Policy exclusions are specific circumstances or situations that are not covered by your insurance policy. The declaration page will typically provide a summary of the policy exclusions applicable to your insurance coverage. These exclusions may vary depending on the type of coverage and the insurance company.

Policy exclusions help define the scope of coverage and prevent insurance claims for certain events or situations. Common exclusions may include intentional acts, war, or damage caused by wear and tear. It’s important to review the policy exclusions to understand the limitations of your coverage.

By understanding the types of coverage, coverage limits, and policy exclusions outlined on your declaration page, you can gain a clear understanding of the protection provided by your insurance policy. If you have any questions or concerns about your coverage details, it’s recommended to reach out to your insurance agent for clarification.

Making Sense of Premiums and Deductibles

Understanding the premiums and deductibles on your insurance declaration page is essential for managing your insurance coverage effectively. Let’s take a closer look at the key components related to premiums, deductibles, and payment schedules.

Premium Amount

The premium amount listed on your insurance declaration page refers to the cost you pay for your insurance coverage. It is typically paid on a monthly, quarterly, or annual basis, depending on the terms of your policy. The premium amount can vary based on several factors, including the type of coverage, coverage limits, deductibles, and your specific risk profile.

When reviewing your premium amount, it’s important to ensure that it aligns with the coverage and benefits provided by your policy. If you have any questions or concerns about your premium, it’s advisable to contact your insurance agent for clarification. They can provide you with the necessary information and help you understand the factors influencing your premium.

Deductible Amount

The deductible amount is the portion of the insurance claim that you are responsible for paying out of pocket before your insurance coverage kicks in. It is a predetermined amount set by your insurance policy and can vary depending on the type of coverage you have.

For example, if you have a $500 deductible and file a claim for $2,000, you would be responsible for paying the first $500, while your insurance company would cover the remaining $1,500. It’s important to note that higher deductibles often result in lower premium amounts, while lower deductibles typically lead to higher premiums.

Understanding your deductible amount is crucial when assessing the financial impact of a potential claim. It’s important to ensure that you are comfortable with the deductible amount and that it aligns with your financial capabilities.

Payment Schedule

The payment schedule on your declaration page outlines the frequency and due dates for your premium payments. Most insurance companies offer flexible payment options, such as monthly, quarterly, or annual payments. It’s important to pay your premiums on time to maintain your insurance coverage and avoid any potential lapses.

If you have concerns about your payment schedule or need to make changes, it’s recommended to reach out to your insurance agent. They can provide guidance on available payment options and assist you in adjusting your payment schedule if necessary.

By understanding the premiums, deductibles, and payment schedule outlined on your insurance declaration page, you can effectively manage your insurance coverage and make informed decisions. If you have any questions or need further clarification, don’t hesitate to contact your insurance agent for assistance.

Utilizing Your Declaration Page

Once you receive your insurance declaration page, it’s important to understand how to effectively utilize the information it provides. Here are three key ways you can make the most of your declaration page:

Reviewing Coverage

The declaration page provides a comprehensive overview of your insurance coverage. Take the time to carefully review this section to ensure that you have the appropriate coverage for your needs. Pay close attention to the types of coverage included, such as liability, property, or medical coverage. Familiarize yourself with the coverage limits, which specify the maximum amount your policy will pay in the event of a claim. Additionally, check for any policy exclusions, which outline situations or events that are not covered by your insurance. Understanding your coverage will help you make informed decisions and ensure you have adequate protection.

Making Changes to Your Policy

Life circumstances may change, and you may need to make adjustments to your insurance policy. The declaration page provides important policy information that will assist you in making these changes. If you need to add or remove coverage, adjust coverage limits, or update your contact information, refer to your declaration page for the necessary details. Reach out to your insurance agent or company to discuss any modifications you wish to make. By keeping your policy up to date, you can ensure that you have the right level of protection for your evolving needs.

Contacting your Insurance Agent

Your declaration page includes contact information for your insurance agent or company. If you have any questions, concerns, or need assistance with your policy, don’t hesitate to reach out to them. Whether you need clarification on coverage details, have a claim to report, or require guidance on making changes to your policy, your insurance agent is there to help. They can provide expert advice tailored to your specific situation and ensure that you have a clear understanding of your policy terms and conditions. Utilize this valuable resource whenever you need assistance navigating your insurance coverage.

By effectively utilizing your declaration page, you can gain a better understanding of your insurance policy and make informed decisions regarding your coverage. Remember to review your coverage periodically, especially when major life events occur, to ensure that your insurance aligns with your current needs. If you have any questions, concerns, or require policy changes, don’t hesitate to contact your insurance agent. They are ready to assist you and provide the support you need to make the most of your insurance coverage.

Conclusion

In the realm of insurance, knowledge is your greatest ally. Your foremost insurance declaration page is more than just paperwork; it’s a roadmap to understanding and optimizing your coverage. By reviewing the policy information, coverage details, and financial aspects diligently, you ensure that your insurance aligns seamlessly with your needs. Periodic reviews, especially during life changes, and effective communication with your Foremost insurance agent, transform your Foremost Insurance declaration page from a document into a tool for tailored protection. Embrace the power of comprehension, and let your Foremost Insurance Declaration page guide you towards a secure and well-informed future.