Insurance cards play a vital role in ensuring that individuals have quick and easy access to their insurance information when needed. Understanding the significance of insurance cards and the reasons for carrying them is essential for every policyholder.

Understanding the Role of Insurance Cards

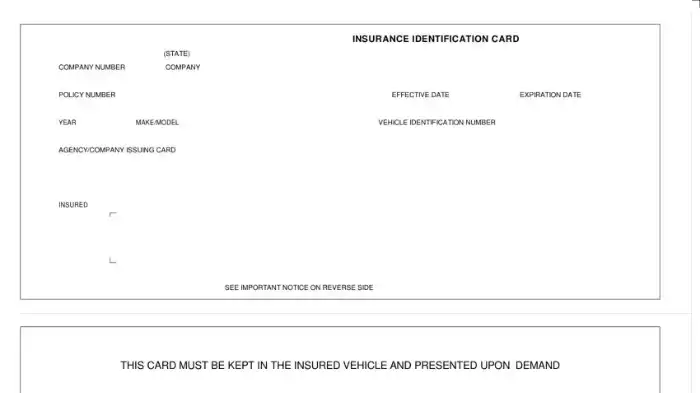

Insurance cards serve as proof of insurance coverage and contain important details about the policy. They typically include information such as the policyholder’s name, policy number, effective dates, and contact information for the insurance company. These cards are issued by insurance providers to their policyholders and are often required to be presented in various situations, such as:

- Visiting healthcare providers: When seeking medical services, healthcare providers may require individuals to present their insurance card to verify coverage and facilitate billing.

- Auto accidents: In the event of an auto accident, insurance cards are essential for exchanging insurance information with other parties involved.

- Property damage claims: When making a property damage claim, such as for home or auto insurance, insurance cards provide necessary policy details to the insurance company.

- Proof of coverage: Insurance cards serve as proof that an individual has active insurance coverage, which may be required in certain situations like renting a car or applying for a loan.

By carrying their insurance cards, individuals can conveniently provide important insurance information whenever necessary, ensuring a smooth process for accessing benefits and services.

Why You Should Always Carry Your Insurance Card

Carrying your insurance card at all times is highly recommended for several reasons. Here are a few key benefits:

- Immediate access to information: Having your insurance card readily available ensures that you can quickly provide essential policy details when needed, allowing healthcare providers, law enforcement, or other relevant parties to verify your coverage and assist you accordingly.

- Prompt medical care: In medical emergencies, time is of the essence. By having your insurance card on hand, healthcare providers can easily identify your coverage, enabling them to proceed with necessary treatments without delays.

- Compliance with legal requirements: Many states and jurisdictions require drivers to carry proof of insurance, which is often fulfilled by carrying an insurance card. Failure to provide proof of insurance when requested can result in penalties or legal consequences.

- Peace of mind: Carrying your insurance card provides a sense of security, knowing that you have immediate access to your policy information in case of unexpected events or emergencies.

It’s important to note that insurance cards should be safeguarded to prevent unauthorized access to your personal information. Additionally, it’s a good practice to keep a digital backup of your insurance card in a secure location, such as a password-protected digital wallet or a dedicated app provided by your insurance company.

Understanding the importance of insurance cards and consistently carrying them ensures that you can navigate insurance-related situations with ease and have peace of mind knowing that you have the necessary documentation readily available when needed.

Introduction to Foremost Insurance

Foremost Insurance is a leading provider of insurance coverage that offers a range of options to meet the diverse needs of individuals and families. Understanding what Foremost Insurance is and the types of coverage it offers can help you make informed decisions when it comes to protecting yourself and your assets.

What is Foremost Insurance?

Foremost Insurance is an insurance company that specializes in providing coverage for a wide range of personal and specialty insurance needs. With a focus on customer service and tailored solutions, Foremost Insurance aims to deliver comprehensive coverage and peace of mind to its policyholders.

Foremost Insurance offers various types of insurance coverage, including:

| Type of Insurance | Description |

|---|---|

| Foremost Short Term Rental Insurance | Insurance coverage for short-term rental properties, such as vacation homes and seasonal rentals. |

| Foremost Car Insurance | Auto insurance coverage to protect against accidents, theft, and other unforeseen events. |

| Foremost Signature Insurance Company | Specialty insurance coverage for unique risks, such as high-value homes, collector cars, and boats. |

| Foremost Camper Insurance | Insurance coverage for recreational vehicles (RVs), including motorhomes, travel trailers, and campers. |

These are just a few examples of the insurance coverage options available through Foremost Insurance. By offering specialized coverage tailored to specific needs, Foremost Insurance aims to provide comprehensive protection for individuals and families.

Understanding the types of insurance coverage offered by Foremost Insurance can help you determine which policies best suit your needs and provide the necessary protection for your assets. Whether you are insuring your home, vehicle, or other valuable possessions, consider exploring the coverage options available through Foremost Insurance to ensure you have the right level of protection.

Accessing Your Foremost Insurance Card

To access your Foremost insurance card, you will need to log into your Foremost online account. Follow the simple steps outlined below to access your insurance card conveniently.

Logging into Foremost Online Account

- Open your preferred web browser and visit the official Foremost website.

- Locate the “Login” or “Account” section on the website’s homepage.

- Click on the appropriate link to access the login page.

- Enter your login credentials, including your username and password. If you have not registered for an online account, you will need to create one by following the registration process provided on the website.

- Once you have entered your login information, click on the “Login” or “Sign In” button to proceed.

Navigating to Your Insurance Card

After logging into your Foremost online account, follow the steps below to locate and access your insurance card:

- Look for the “Policy Documents” or “Documents” section within your account dashboard. This section may be labeled differently depending on the specific layout of the website.

- Click on the relevant link to access your policy documents.

- Within the policy documents section, you should find a list of available documents related to your insurance policy. Look for the document labeled “Insurance Card” or “ID Card.”

- Click on the “Insurance Card” or “ID Card” document to open it.

Once you have accessed your Foremost insurance card, you can choose to print it or save a digital copy for easy access. It’s recommended to keep both a physical and digital copy of your insurance card in case of emergencies.

Remember to review the information on your insurance card to ensure its accuracy. If you notice any discrepancies or outdated information, contact Foremost customer service to request an updated card.

For more information about Foremost Insurance and the types of coverage they offer, refer to our article on foremostpayonline.

Printing Your Foremost Insurance Card

Once you have accessed your Foremost insurance card through your online account, you may need a physical copy for various purposes. Printing your Foremost insurance card is a simple process that ensures you have a tangible proof of your coverage readily available. Here is a step-by-step guide to help you through the process:

Step-by-Step Guide to Printing

- Open the digital copy of your Foremost insurance card on your computer.

- Ensure that your computer is connected to a printer and that it has enough paper and ink or toner.

- Click on the “Print” option usually found in the top menu or by right-clicking on the screen and selecting “Print.”

- In the printer settings, verify that the correct printer is selected.

- Choose the number of copies you wish to print.

- Adjust any additional print settings such as paper size, orientation, or color preferences if needed.

- Double-check that all the necessary information on the insurance card is visible and clear in the print preview.

- Click “Print” to initiate the printing process.

- Wait for the printer to complete the printing task.

- Collect the printed insurance card from the printer.

Tips for Ensuring Print Quality and Legibility

To ensure the print quality and legibility of your Foremost insurance card, consider the following tips:

- Use a high-quality printer: Opt for a printer that produces clear and crisp prints to ensure that all the details on your insurance card are easily readable.

- Check ink or toner levels: Ensure that your printer has enough ink or toner to avoid any inconsistencies or faint prints.

- Use the correct paper size: Select the appropriate paper size (e.g., letter, A4) to match the dimensions of your insurance card.

- Use a clean printing surface: Make sure the paper is free from dirt, dust, or any other debris that could affect the print quality.

- Verify the legibility of the information: Before using the printed insurance card, confirm that all the text, numbers, and barcodes are clear and legible.

- Consider laminating the card: For added protection and durability, you may choose to laminate the printed insurance card. This helps prevent wear and tear and keeps the card in good condition for an extended period.

Printing your Foremost insurance card ensures that you have a physical copy readily available whenever it is required. By following the step-by-step guide and implementing the provided tips, you can ensure that your printed insurance card is of high quality, legible, and serves as a reliable proof of your coverage.

Protecting Your Foremost Insurance Card

Once you have obtained your Foremost insurance card, it is essential to take measures to protect it. Your insurance card serves as proof of your coverage and should be safeguarded to ensure its availability and validity when needed. Here are some important steps to consider for protecting your Foremost insurance card:

Importance of Safeguarding Your Card

Protecting your Foremost insurance card is crucial for several reasons. Firstly, it serves as proof of your insurance coverage in various situations, such as during a traffic stop or when accessing healthcare services. Keeping your card safe and readily available can help facilitate a smooth and efficient process when you need to provide proof of insurance.

Additionally, protecting your insurance card helps prevent unauthorized use or fraudulent activities. If your card falls into the wrong hands, someone could potentially misuse your insurance information, leading to complications and potential financial loss. Safeguarding your card can help minimize the risk of identity theft or fraudulent claims.

Digital Alternatives and Backup Options

In addition to keeping a physical copy of your Foremost insurance card, it is wise to consider digital alternatives and backup options. Storing a digital copy of your insurance card on your smartphone or other electronic devices can provide an extra layer of protection. This way, even if you misplace or lose your physical card, you can still access your insurance information when needed.

To create a digital backup of your insurance card, you can either take a clear photograph or scan the card and save it as an electronic file. Make sure to store the digital copy in a secure location, such as a password-protected folder or a reputable cloud storage service. This way, you can easily retrieve the digital copy whenever required.

It’s worth noting that while a digital copy of your insurance card can be convenient, it’s important to ensure that it is easily accessible, especially in situations where an internet connection may not be available. Therefore, it is advisable to keep both physical and digital copies of your insurance card to ensure you are prepared for any situation.

Remember to periodically review and update the information on your insurance card to ensure its accuracy. If there are any changes to your coverage or personal details, contact Foremost or your insurance agent to obtain an updated card.

By taking the necessary steps to protect your Foremost insurance card and having digital alternatives or backup options available, you can have peace of mind knowing that your insurance information is secure and easily accessible when needed.