Selling your house involves a myriad of decisions, and one crucial aspect is understanding when and how to cancel homeowners insurance during the process. In our blog, “Smart Moves: Timing the Cancellation of Homeowners Insurance When Selling Your House,” we delve into the intricacies of this essential step.

From the significance of homeowners insurance in safeguarding your investment to navigating the complexities when selling with or without a mortgage, we provide insights into the factors influencing the cancellation timeline. Discover the smart moves, including assessing insurance needs, coordinating with your lender, and the pivotal question of ‘when to cancel homeowners insurance when selling house.’ Navigate the selling process confidently with our comprehensive guide.

Understanding Homeowners Insurance When Selling Your House

When selling your house, it’s important to understand the role and importance of homeowners insurance throughout the process. Homeowners insurance provides financial protection against potential damages or losses to your property and belongings. It not only safeguards your investment but also provides you with peace of mind.

The Importance of Homeowners Insurance

Homeowners insurance is essential because it offers coverage for various risks that your property may face. It typically includes protection against hazards such as fire, theft, vandalism, and natural disasters like storms or earthquakes. In addition to property coverage, homeowners insurance often includes liability protection, which covers you in case someone gets injured on your property and files a claim against you.

By having homeowners insurance, you can protect your financial interests in case of unforeseen events. It allows you to rebuild or repair your home, replace damaged or stolen belongings, and cover any legal expenses that may arise from liability claims. Without insurance coverage, you could face significant financial burdens that may be difficult to overcome.

Factors to Consider When Selling Your House

When selling your house, you need to consider several factors related to your homeowners insurance. These factors can affect the timing and process of canceling your insurance policy:

- Closing Date: The closing date of the sale is crucial because it determines when the ownership of the property transfers to the buyer. It’s important to coordinate the cancellation of your homeowners insurance with the closing date to ensure that you are not left without coverage before the sale is finalized.

- Mortgage Requirements: If you have a mortgage on your property, your lender typically requires you to maintain homeowners insurance until the loan is paid off. You must fulfill these requirements until the sale is complete or transfer the insurance obligations to the new buyer.

- Home Inspection and Repairs: Before selling your house, it’s common for buyers to request a home inspection. The inspection may uncover issues that need to be addressed before the sale. It’s important to maintain homeowners insurance during this period to protect yourself from any potential liability claims arising from these issues.

- New Home Purchase: If you are selling your current house and purchasing a new one, it’s essential to ensure a smooth transition of insurance coverage. You may need to coordinate the cancellation of your current policy with the start of a new policy for your new home.

By carefully considering these factors, you can make informed decisions about your homeowners insurance when selling your house. It’s advisable to consult with your insurance agent and any involved parties to ensure a seamless transition and avoid any gaps in coverage.

Cancelling Homeowners Insurance

When selling your house, it’s important to consider cancelling your homeowners insurance at the appropriate time. Cancelling your insurance too soon or too late can lead to unnecessary expenses or gaps in coverage. In this section, we will explore when to cancel homeowners insurance and why timing matters.

When to Cancel Homeowners Insurance When Selling House?

The ideal time to cancel your homeowners insurance is typically after the sale of your house has been finalized. This ensures that you have coverage in place until the transaction is complete and ownership of the property has officially transferred to the new owner. It’s important to consult your insurance policy or speak with your insurance provider to understand the specific requirements and guidelines for cancellation.

In some cases, you may need to provide proof of sale or a copy of the closing statement to initiate the cancellation process. Keep in mind that cancelling your homeowners insurance too early can leave you uninsured if any unforeseen events occur during the transition period. It’s always better to err on the side of caution and maintain coverage until the sale is complete.

Why Timing Matters

Timing is crucial when cancelling homeowners insurance because it affects your financial responsibility and liability as a property owner. Until the sale is finalized, you are still responsible for the property and any potential risks associated with it. Maintaining insurance coverage during this time helps protect you from potential liabilities and ensures that the new owner assumes responsibility for the property’s insurance.

Additionally, cancelling your homeowners insurance too early may result in financial consequences. If an incident occurs during the transition period and you no longer have insurance, you may be personally liable for any damages or losses. This can have significant financial implications, especially if the incident involves a substantial claim.

By understanding when to cancel homeowners insurance and the importance of timing, you can navigate the process of selling your house with confidence. Always communicate with your insurance provider and follow their guidelines to ensure a smooth transition and avoid any potential gaps in coverage. For more information on homeowners insurance and related topics, refer to our articles on foremost insurance and what is foremost insurance.

Selling Your House with a Mortgage

When selling a house with an existing mortgage, there are certain considerations to keep in mind regarding homeowners insurance. Let’s explore the role of your lender and the insurance requirements and obligations involved.

The Role of Your Lender

Your lender plays a crucial role when it comes to homeowners insurance during the selling process. Since the lender has a financial stake in the property, they want to ensure that it is adequately protected until the mortgage is fully paid off or transferred to a new owner.

Typically, your lender will require you to maintain homeowners insurance coverage throughout the selling process. This is to protect their investment and safeguard against potential risks, such as damage or liability claims. It’s important to review your mortgage agreement or contact your lender directly to understand their specific requirements.

Insurance Requirements and Obligations

When selling your house with a mortgage, you need to comply with the insurance requirements and obligations outlined by your lender. These may include:

- Proof of Insurance: Your lender will typically require proof of homeowners insurance coverage. This proof is often requested by the buyer’s lender as well, as part of the closing process. Ensure that you have the necessary documentation ready to provide to all relevant parties.

- Named Insured: The homeowners insurance policy should list both you and your lender as named insured parties. This means that in the event of a claim, the insurance proceeds would be payable to both you and the lender, protecting their financial interest in the property.

- Notification of Changes: If you make any changes to your homeowners insurance policy, such as canceling or modifying coverage, it’s essential to inform your lender promptly. They need to be aware of any changes that may affect the insurance coverage on the property.

- Policy Continuation: Until the sale of your house is finalized, you must maintain continuous homeowners insurance coverage. This ensures that the property remains protected against potential risks during the transition period.

By understanding the role of your lender and adhering to the insurance requirements and obligations, you can navigate the selling process smoothly while fulfilling your contractual obligations. It’s advisable to communicate with your lender and insurance provider early on to ensure compliance and address any questions or concerns you may have.

Selling Your House without a Mortgage

When selling your house without a mortgage, there are a few important considerations to keep in mind regarding your homeowners insurance. Assessing your insurance needs and transitioning to a new policy are key steps in ensuring a smooth process.

Assessing Your Insurance Needs

Before selling your house, it’s essential to reassess your insurance needs. Determine the coverage required for your property during the selling process. While your existing homeowners insurance policy may still provide coverage, it’s important to consult with your insurance company to clarify any limitations or adjustments needed.

Consider factors such as the length of time your house will be vacant during the selling process. Depending on the duration, your insurance company may require additional coverage or endorsements to ensure adequate protection against potential risks, such as vandalism or theft.

Additionally, if you plan to purchase a new property after selling your house, it’s crucial to review your insurance needs for the new property. This may involve obtaining a new homeowners insurance policy or transferring your existing policy, depending on your insurer’s policies and the specific requirements of your new property.

Transitioning to a New Policy

Once you have assessed your insurance needs for the selling process and beyond, it’s time to transition to a new policy if necessary. If you plan to purchase a new property, contact your insurance company to discuss the process of transferring your existing homeowners insurance policy or obtaining a new policy to cover your new property.

During this transition, it’s important to ensure continuous coverage to protect your new investment. Coordinate with your insurance company and the closing process to ensure a seamless transition from your current policy to the new one. Keep in mind that your insurance needs may differ for the new property, so it’s essential to review the coverage options available and make informed decisions based on your specific requirements.

Remember to notify your insurance company of any changes in your homeownership status, providing them with the necessary information about the sale of your house and the purchase of a new property. This allows them to update your policy and ensure appropriate coverage during the transition period.

By assessing your insurance needs and transitioning to a new policy as required, you can navigate the process of selling your house without a mortgage while maintaining adequate insurance coverage. Consult with your insurance company for personalized guidance and recommendations based on your specific circumstances.

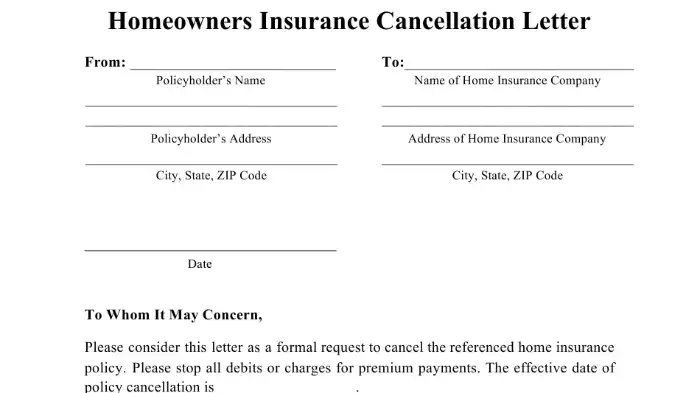

Steps to Take When Cancelling Homeowners Insurance

When selling your house, cancelling your homeowners insurance is an important step in the process. To ensure a smooth transition, there are several steps you should take when cancelling your insurance policy.

Notifying Your Insurance Company

The first step in cancelling your homeowners insurance is to notify your insurance company. Contact them to inform them of your plans to sell your house and request the cancellation of your policy. It’s important to provide them with the necessary details, such as the effective date of the cancellation. This will allow them to update their records accordingly.

Documenting the Cancellation

To protect yourself and ensure a clear record of the cancellation, it’s important to document the process. Request written confirmation from your insurance company stating that your policy has been cancelled effective from the agreed upon date. This documentation can be useful in case of any disputes or issues that may arise in the future.

Seeking Pro-rated Refunds

When cancelling your homeowners insurance, you may be eligible for a pro-rated refund of the premium you have paid. The amount of the refund will depend on the terms and conditions of your policy and the effective date of the cancellation. Contact your insurance company to inquire about any potential refunds and the process for receiving them.

It’s important to note that if you are selling your house with a mortgage, your lender may require you to maintain insurance coverage until the sale is complete. Make sure to communicate with your lender and understand their insurance requirements and obligations. For more information on selling your house with a mortgage, refer to the section on Selling Your House with a Mortgage.

By following these steps, you can ensure a smooth and efficient cancellation of your homeowners insurance when selling your house. Remember to notify your insurance company, document the cancellation, and inquire about any potential refunds. It’s important to stay informed and proactive throughout the process to protect yourself and comply with any obligations.

Conclusion

In conclusion, navigating the cancellation of homeowners insurance when selling your house requires careful consideration of factors such as the closing date, mortgage requirements, and potential home repairs. Timing is crucial, and canceling too early or too late can have financial implications. Whether selling with or without a mortgage, understanding your lender’s role and adhering to insurance obligations is essential. Assessing insurance needs and coordinating with your insurance company for a seamless transition are key steps. Remember, “when to cancel homeowners insurance when selling house” is a critical question, and the ideal time is typically after the sale is finalized. By following these steps, you can confidently navigate the process, ensuring financial protection and a smooth transition for both you and the new homeowner.